The main advantage of virtual CFO Services in Dubai is the flexibility and cost-effectiveness they provide. Businesses can access the skills and experience of a CFO without the expense of hiring a full-time executive.

A Part-time / Virtual Chief Financial Officer (CFO) is a professional who provides financial leadership, strategic planning services and guidance to a company. They typically work with small and medium-sized businesses that do not have the resources or need for a full-time CFO.

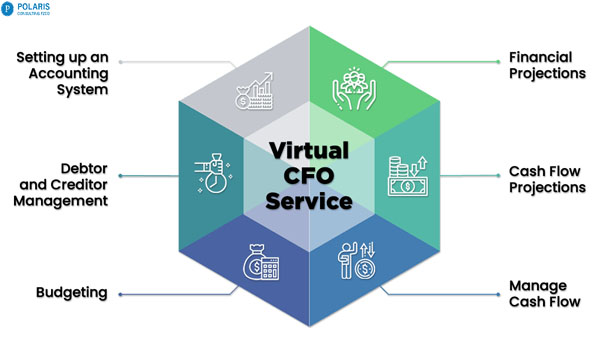

A Part-time / Virtual CFO will work with the company's management team to set financial goals and create a plan to achieve them. This may involve analyzing the company's financial position, forecasting future performance, and developing budgeting and forecasting models.

Managing Financial Operations:A Part-time / Virtual CFO may be responsible for managing the day-to-day financial operations of the company, including tasks such as payroll, accounts payable, and accounts receivable.

Operational Support:

A Part-time / Virtual CFO can provide financial guidance and support on day-to-day operations, such as pricing, cost control, and cash flow management.

Providing Financial Planning, Analysis and Reporting:A Part-time / Virtual CFO will help plan, allocate resources, provide regular financial reports and analysis to the company's management team and board of directors, helping them understand the company's financial performance and identify areas for improvement.

Financial Modelling:A Part-time / Virtual CFO can create financial models to help businesses make informed decisions about investments and other financial matters.

Mergers and Acquisitions:A Part-time / Virtual CFO can assist with the financial aspects of mergers and acquisitions, including due diligence, valuation, and financing.

Advising on Financial Decisions:A Part-time / Virtual CFO will provide guidance and advice to the company's management team on financial matters, such as raising capital, making investments, and developing new products or services.

A Part-time / Virtual CFO can help businesses identify and mitigate financial risks.

Ensuring Compliance with Financial Regulations:A Part-time / Virtual CFO will ensure that the company is in compliance with all relevant financial regulations, including tax laws and accounting standards.

Overall, the role of a Part-time / Virtual CFO is to provide financial leadership and guidance to a company, helping achieve their financial and business goals, and maintain financial stability.

Virtual CFO services can be customized to meet the specific needs of each business, providing valuable financial expertise and guidance to support growth and sustainability. By leveraging the knowledge and experience of virtual CFOs, businesses can enhance their financial management capabilities and make informed decisions to drive success.